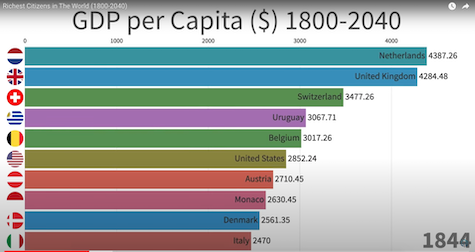

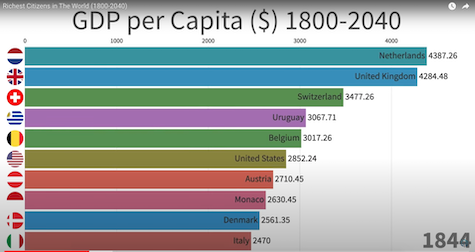

Countries with the highest GDP per capita between 1800-2040

Hot Issues

January - March 2023 archive

When the personal intersects with the commercial – specifically, in the context of a family law dispute – shareholders agreements can be subjected to an unexpected level of scrutiny by Australian family law courts, writes Kristy-Lee Burns.

Recent ATO guidance on profit allocation will result in higher personal income tax bills for professionals restructuring their profits through trusts, RSM has said.

Despite the long-term benefits of well-managed super, many aren’t motivated or don’t know where to start.

Trading terms are the contract that outlines how you do business. They provide an overview of the rights and obligations of you and your customers.

We specialize in providing proactive tax planning strategies for our clients. High earning individuals and business clients can benefit by speaking to one of our tax advisors.

Good, fundamental book keeping will ensure that your accounts are up to date and give you proper control of your business. With over 85% of business failure attributed to poor financial control, skilled and professional bookkeeping will give you results that speak for themselves.

Taking the time to plan for your future makes good financial sense. Ensure you have the money to live the lifestyle you'd like during your retirement.

Preparation of negative gearing tax schedules for all investment properties. Including Depreciation Calculations and Special Building Write offs.